ny highway use tax form mailing address

Save this item to your account. GREEN ISLAND NY 12183-1515.

How To Fill Out Irs Form 1040 For 2020 Youtube

Number mailing or business address telephone number or ownerofficer.

. If you need to report any other changes for your business records you must use Form DTF-95 Business Tax Account Update. BOX 5564 BINGHAMTON NY 13902-5564 RETURNS CLAIMING REFUNDS NYC DEPARTMENT. Instructions for Form MT-903 Highway Use Tax Return MT-903-I 122.

To change only your address use Form DTF-96Report of Address Change for Business Tax Accounts. You can also grant a New York State tax preparer access to Web File for you. NYS Tax ID - Enter your FEIN federal employer identification number including the suffix numbers or SS if applicable.

18 rows DTF-406. Youll receive a bill in the mail for the missing payment. Select the option to change your address.

To receive written proof of the delivery date see the list of Designated Private Delivery Services. To use OSCAR all you need is an active USDOT number and a Highway Use Tax HUT account Read the instructions Form TMT-1-I before completing this form. If you use any private delivery service send the forms to.

Mailing or business address telephone number or ownerofficer information complete Form DTF-95Business Tax Account Update. If you have not yet enrolled in OSCAR select Enroll Now. MT-903-MN Highway Use Tax Return.

Form MT-903 is filed monthly annually or quarterly based on. The Federal Heavy Vehicle Use Tax HVUT is required and administered by the Internal Revenue Service IRS. Tax Type Form Number Mailing Address Business Tax Form - New Mailing Addresses NYC-1 NYC-1A NYC-3360B NYC-4S NYC-4SEZ NYC-3A NYC-3L NYC-245 NYC-3360 NYC-115 NYC-202 NYC-202EIN NYC-202S NYC-204 NYC-204EZ RETURNS NYC DEPARTMENT OF FINANCE PO.

Kansas City MO 64999-0052. Read about the HVUT at the web site of the US Internal Revenue Service or. Enter only numbers andor letters no dashes must be 9 to 11 characters.

New York State Department of Taxation and Finance. We offer a number of instructional presentations to help you get started. NYS Taxation and Finance Department.

You can report address changes on Form DTF-95 instead. 122 legal name mailing address number and street or po box city state zip code. HUTIFTA Application Deposit Unit.

In the instructions or visit our Web site at wwwtaxnygov or call 518 457-5431. For forms and publications call. For forms and publications call.

New York State highway use tax TMT New York State Highway Use Tax TMT is imposed on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. If you are receiving this message you have either attempted to use a bookmark without logging into your account or you have timed out. Partner officer member or individual with a Power of Attorney on file with the New York.

Kansas City MO 64999-0045. Form MT-903 is filed monthly annually or quarterly based on the. Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55000 pounds or more.

New York State highway use tax return visit our Web site at wwwnystaxgov. Password - Enter your current OSCAR password. For more information contact.

If you do not know your password please. 2 USDOT number 3 Telephone number 4 E-mail address 5 Fax number 6 Legal name 7 Doing. IFTA Quarterly Fuel Use Tax Return.

Highway Use Tax Web File You can only access this application through your Online Services account. NYS Taxation and Finance Department. The following is a list of telephone numbers for which we often receive requests.

The private delivery service address was changed on August 28 2015. IFTA-21 Fill-in IFTA-21-I Instructions New York State International Fuel Tax Agreement IFTA Application. Unless specified all numbers are within the Main Office of NYS Department of Transportation located in Albany.

Location physical address or mailing address or both for business tax accounts on record with the New York State Department of Taxation and Finance Tax Department. For more information contact. Ny Highway Use Tax Form.

If you have been issued a certificate of registration certificate or if you operate a motor vehicle as defined in Tax Law Article 21 in New York State. Any registration application including Forms TMT-1 TMT-39 and TMT-334. HUTIFTA Application Deposit Unit.

Internal Revenue Service. Claim for Highway Use Tax HUT Refund. 24 rows highway usefuel use tax ifta form number instructions form title.

Proof of payment is a. Instructions for Form MT-903 Highway Use Tax Return MT-903-I 199 Who Must File You must file Form MT-903Highway Use Tax Return if you have been issued a highway use tax permit or you operate a motor vehicle as defined in Article 21 of the Tax Law in New York State. Federal law requires proof that the HVUT tax was paid when you register a vehicle that has a combination or loaded gross vehicle weight of 55000 pounds or more.

Taxpayer ID number Name Period covered Begin date mmddyy End date mmddyy Number and street or PO box Due date mmddyy City state ZIP code If there are any changes in your business name ID. Who must file You must file Form MT903 Highway Use Tax Return if you have been issued a certificate of registration certificate or if you operate a motor vehicle as defined in. Form DTF-406 Claim for Highway Use Tax HUT Refund.

New York Heavy Use Tax A HUT certificate of registration is required for any truck tractor or other self-propelled vehicle with a gross weight over 18000 pounds in the State of New York. Department of Taxation and Finance. If you elect to use the unloaded weight method to file your returns a certificate is required for any truck with an unloaded weight over 8000 pounds and.

This form replaces Forms IFTA-1 and IFTA-9. The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the. Department of the Treasury.

If you need a form see Need help.

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

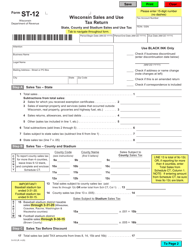

Form St 12 Download Fillable Pdf Or Fill Online Wisconsin Sales And Use Tax Return Wisconsin Templateroller

Today S Document From The National Archives Tax Forms Federal Income Tax Income Tax

2013 Tax Information Form W 2 Wage And Tax Statement Form 1099

Irs Tax Notices Explained Landmark Tax Group

Notary Public Address Change Notary Public Notary Public

Fill Free Fillable Forms For New York State

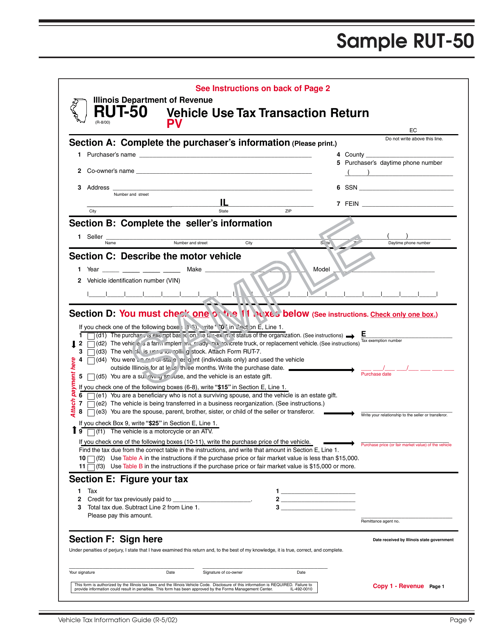

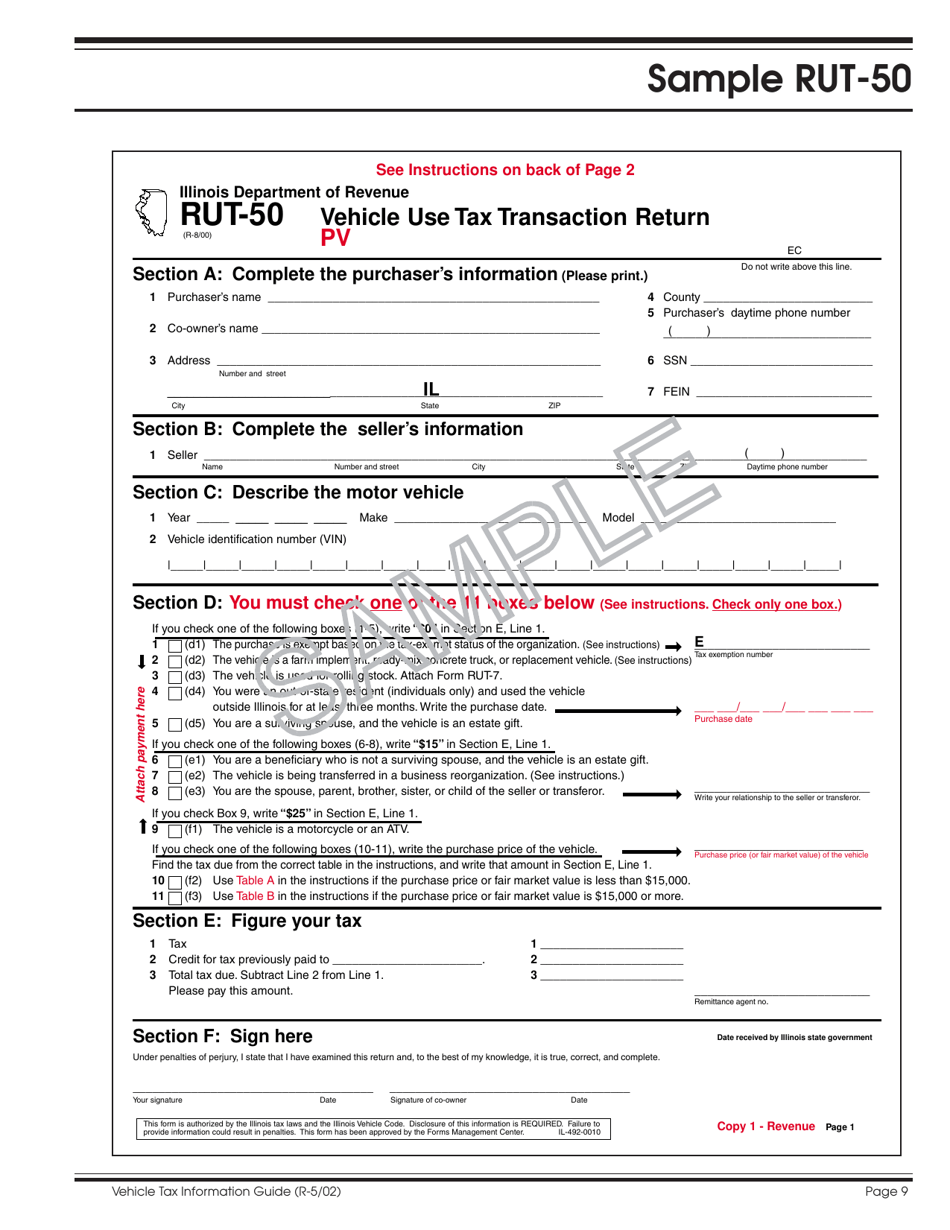

Sample Form Rut 50 Download Printable Pdf Or Fill Online Vehicle Use Tax Transaction Return Illinois Templateroller

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Unified Carrier Registration For Trucking Companies Trucking Companies Commercial Vehicle Carriers

Gig Workers Need To Get Ready For Tax Forms Protocol

Cedar Rapids Seizing Income Tax Returns For Nonpayment Of Traffic Camera Tickets Little Village Income Tax Return Traffic Camera Cedar Rapids

Gig Workers Need To Get Ready For Tax Forms Protocol

2021 Instructions For Schedule H 2021 Internal Revenue Service

2019 Tax Information Form W 2 Wage And Tax Statement Form 1099

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Last Week Of The Month Has Begun Only 5daystogo Heavy Vehicle Use Tax Hvut Form2290 Filing For Taxyear 2018 2019 Understanding Supportive Federation

Sample Form Rut 50 Download Printable Pdf Or Fill Online Vehicle Use Tax Transaction Return Illinois Templateroller